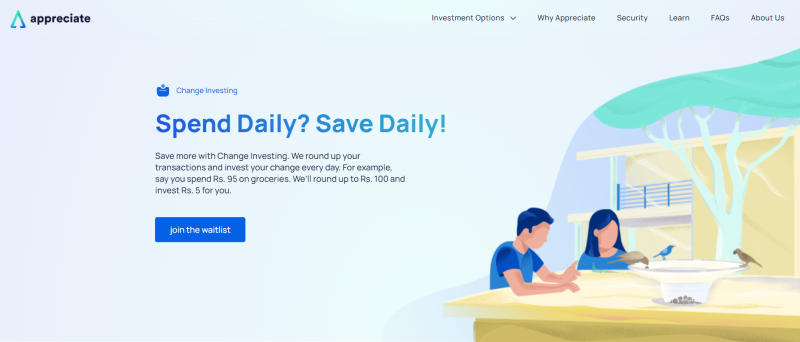

The world of stock investments has experienced a dramatic shift as various stock market apps like Appreciate have emerged. These groundbreaking platforms reshape how individuals buy/sell stocks – making investing more accessible and convenient. This article will examine how these apps transform financial markets, discussing their impact on investors and the broader economic landscape.

Democratizing Access to the Financial Markets

One of the key benefits of any share market app is making it easier for everyone to access financial markets. In the past, buying stocks involved opening an account at a brokerage firm. Due to the high fees and account minimums, this created a significant barrier to entry. However, stock trading apps have significantly reduced these barriers, enabling people with cell phones and computers to buy and sell stocks seamlessly. This has allowed people of all incomes and financial knowledge to partake in the stock market.

Expanding Investor Participation

Stock trading apps, such as Appreciate, have contributed to a massive number of individual investors entering the stock market. The possibility of trading stocks on their mobile phones has encouraged more people to invest and adjust their respective financial portfolios.

Fractional Shares Overview

Another revolutionary feature of stock trading apps is the possibility of buying fractional shares. In the past, investors could only buy whole shares from the global share market, leading this process to be expensive due to the high price of individual stocks. But now, users have the opportunity to invest in a fraction of a share, which allows them to become owners of a piece of a share worth several dollars. This has drastically broadened the sphere of investors and eased the way people can invest.

Promoting Financial Literacy

Stock trading apps have also contributed a lot to promoting financial literacy among their users. Most of the apps, including Appreciate, have a user-friendly interface and learning resources that help users learn investing while engaging in trading. Users are given access to an extensive list of tutorials, articles, and videos, including the basics of US stock exchange, portfolio building, and risk management.

Challenges and considerations

The best stock market app may provide many advantages to investors but also involve several challenges and considerations. Firstly, the convenience and availability of leverage can incentivize users to trade recklessly, speculatively, or on a short-term basis. Secondly, the reliance on technology creates the possibility of technical failures or hacking that can disrupt trading activity. Thirdly, investors need to consider and address the factors listed above by taking actions to reduce risk when using stock trading apps.

To sum up, Appreciate and similar apps for trading stocks are greatly changing the involvement of individual investors in the global stock market. They give more people access, get more investors involved, introduce new features, and help teach about finance. However, investors should be careful with these apps and watch for risks. With good education and risk management, stock trading apps can help people build wealth and meet money goals in the digital world.