A demat account plays a central role for individuals who invest stock market instruments or manage portfolios through mutual funds apps. While most investors focus on brokerage or transaction fees, the concept of a demat account limit and its related charges often receives less attention. Over time, ignoring this aspect can lead to avoidable costs and operational inconvenience.

This article explains what a demat account limit means, how charges are structured around it, and why understanding these limits matters for modern investors. Whether you invest stock market securities actively or rely on mutual funds apps for long-term planning, clarity on demat limits helps you stay in control of your financial setup.

What Is a Demat Account Limit?

A demat account limit generally refers to the capacity or threshold associated with holdings, transactions, or value maintained in a dematerialized account. Unlike physical certificates, digital holdings are stored electronically, but they are still governed by operational ceilings set by depository systems and intermediaries.

These limits may relate to:

- The total value of securities held

- The number of securities credited or debited

- Transaction frequency over a period

- Settlement-related thresholds

Such limits are not designed to restrict investors but to ensure smooth settlement, risk control, and regulatory compliance.

Why Demat Account Limits Exist

Demat limits are structured to balance efficiency and risk. When investors invest stock market instruments frequently or hold diversified assets across equity, debt, and funds, systems must handle volume without errors.

Limits help in:

- Preventing settlement failures

- Managing operational risks

- Ensuring regulatory transparency

- Supporting secure record maintenance

For users of mutual funds apps, demat limits also support seamless integration between investment platforms and depository records.

Types of Charges Linked to Demat Account Limits

Account Maintenance Charges

One of the most common charges is the annual or periodic account maintenance cost. In some cases, this fee may vary depending on the value or volume of holdings maintained within the demat account limit.

Higher holdings or frequent activity can sometimes place an account in a different fee structure.

Holding-Based Charges

Some systems calculate charges based on the total value of securities held. When holdings cross certain thresholds, additional charges may apply. This is especially relevant for long-term investors who invest stock market assets consistently over time.

Transaction-Related Charges

Exceeding standard transaction limits within a billing cycle may result in additional fees. These charges are often applied per debit or credit entry once predefined thresholds are crossed.

Investors using mutual funds apps that execute systematic investments should be aware of how repeated credits affect transaction counts.

Demat Account Limit and Investment Behavior

Impact on Active Investors

Active traders often reach transaction-related limits faster due to frequent buying and selling. While the demat account itself is not restrictive, exceeding operational thresholds can influence total costs.

Understanding these limits allows active investors to plan trades more efficiently and avoid unnecessary charges.

Impact on Long-Term Investors

Long-term investors who invest stock market instruments steadily may encounter value-based thresholds instead of transaction-based ones. Over time, portfolio growth itself can trigger higher maintenance or holding-related charges.

Being aware of this helps in planning asset allocation without surprises.

Role of Demat Limits in Mutual Fund Investments

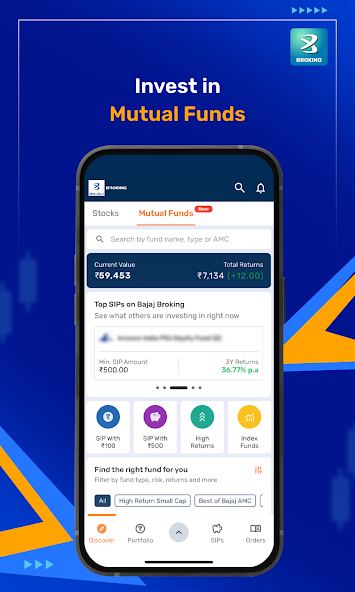

Many investors now rely on mutual funds apps for portfolio diversification. While mutual fund units can be held in demat form, the same account limits and charge structures may apply.

For systematic investment approaches, frequent credits can accumulate transaction counts. Knowing how these limits work ensures that investors maintain cost efficiency while continuing disciplined investing.

How to Manage Demat Account Limit Charges

Monitor Account Statements Regularly

Periodic review of demat statements helps identify whether holdings or transaction volume are approaching charge-linked thresholds.

Align Investment Frequency

Instead of fragmented transactions, consolidating investments where possible can reduce the likelihood of crossing transaction limits, especially for those who invest stock market assets frequently.

Plan Portfolio Growth Strategically

As portfolios grow, investors should reassess whether the current demat structure aligns with long-term goals. This is particularly relevant for investors expanding holdings through mutual funds apps and direct securities.

Regulatory Perspective on Demat Account Limits

Demat account limits and associated charges operate under regulatory frameworks designed to protect investors and maintain system integrity. These frameworks ensure:

- Transparent disclosure of charges

- Fair application of limits

- Standardized settlement processes

Investors benefit when they understand these structures rather than treating charges as unpredictable costs.

Common Misunderstandings About Demat Limits

Limits Are Not Investment Caps

A demat account limit does not restrict how much you can invest stock market assets in total. It only defines operational or charge-related thresholds.

Higher Limits Do Not Always Mean Higher Costs

Not all increases in limits automatically lead to higher charges. Costs depend on how limits are structured and how the account is used.

Mutual Fund Holdings Are Not Exempt

Units held through mutual funds apps in demat form still fall within demat account considerations, including limits and transaction counts.

Importance of Awareness for Modern Investors

As digital investing becomes more accessible, many investors open accounts quickly without fully understanding structural details. Awareness of demat account limits empowers investors to:

- Avoid hidden costs

- Maintain operational efficiency

- Make informed decisions as portfolios grow

This understanding is especially valuable for individuals balancing direct investments and mutual funds apps within a single financial ecosystem.

Conclusion

Understanding charges tied to a demat account limit is an essential part of responsible investing. Whether you invest stock market instruments actively or rely on mutual funds apps for consistent portfolio building, knowing how limits influence costs helps protect long-term returns.

A demat account is more than just a holding facility. It is an operational framework with defined thresholds that impact expenses and efficiency. By monitoring usage, aligning investment strategies, and staying informed, investors can manage demat account limits effectively while continuing their investment journey with clarity and confidence.