Operating a business in today’s fast-paced digital age takes more than just a great idea. It takes effective tools that can make operations easier, make payments smoother, and provide financial flexibility. Whether you are an aspiring entrepreneur or a small business owner, having the right financial tools can be the turning point in managing your cash flow and fueling your growth. Let’s dive into four must-have tools that every contemporary business should utilize: a business credit card, a merchant payment app, a business UPI, and a business loan app.

1. Business Credit Card: Flexibility with Accountability

A business credit card is not just an alternative method to pay; it’s a money partner for your business. Unlike consumer cards, business credit cards tend to have larger lines of credit, tailored spending reports, cash rewards on business spend, and greater rewards customized for business purposes.

Additionally, they assist in creating your business’s credit history, which is important when you need to secure bigger business loans in the future. It’s also simpler to distinguish personal and business expenditures, allowing you to maintain your accounting books in good health and file taxes hassle-free.

2. Merchant Payment App: Accept Payments Anywhere, Anytime

The days when taking payments meant cash or card-swiping devices are over. Merchant payment apps today provide a smarter, contactless, and more efficient means of taking money from customers, be it in-store or online.

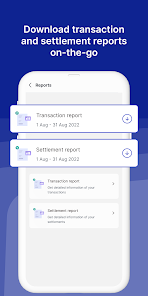

These apps accept various modes of payment, such as QR, NFC, and digital wallets, so businesses can leverage the convenience that customers anticipate. Real-time alerts and daily reports on sales enable merchants to make faster decisions and monitor their income without having to wait for end-of-month statements.

3. Business UPI: Era of Instant & Secure Transfers

India’s UPI revolution has changed the way we manage money, and businesses are now adopting business UPI systems in greater numbers than ever before. A business UPI allows companies to make and receive payments instantly, with minimal transaction fees and unparalleled convenience.

With one-time UPI IDs tailored for businesses, you can provide instant payment solutions to your customers and vendors. This not only instills confidence but also shortens your payment cycles, enhancing your working capital.

4. Business Loans App: Instant Funds, When You Need Them

Cash flow bumps can stop your business expansion if not resolved on time. That’s where a business loans app comes in. These apps are created to give small business owners quick access to financing without the annoying paperwork and holdups of the traditional bank.

From term loans & credit lines to invoice financing, these apps offer multiple lending options tailored to your business needs. What’s more, they often come with real-time approval tracking, easy EMI calculators, and flexible repayment terms.

Final Thoughts

Managing a business in 2025 isn’t just about selling great products or services—it’s also about being financially agile. Whether it’s getting rewards with your business credit card, simplifying collections through a merchant payment app, enabling instant transactions with business UPI, or securing quick funds via a business loans app, these tools are here to empower your business journey.