Technology is changing rapidly in this 21st century, and this technical transformation is reshaping the whole world significantly. With the help of technological advancements, the lending sector is also experiencing new changes among customers and borrowers. It results in changing the personal loan sectors with their operational procedures. The way it is changing was unbelievable a few years back. But nowadays, these changes benefit both the loan sectors and borrowers’ lending behaviors.

- Digital infrastructure of the personal loan sector

India has made a remarkable effort to close the digital divide by supporting payment methods like net banking, UPI, etc., and core infrastructure like internet connectivity. By making this smooth financial pathway for all, the proper foundation has been established to close the credit gap in the nation. It is also delivering credit assets and value-added services with the help of digital benefits.

- Easy availability

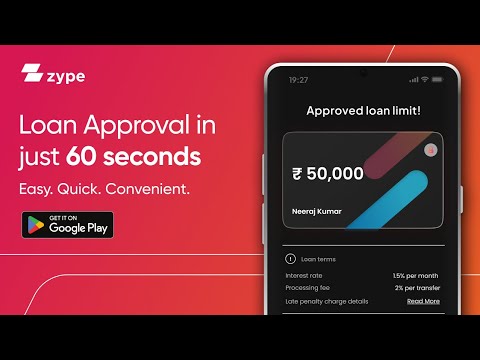

Everyone can indeed use the Internet these days. People have facilities of various smart devices to use the network. This internet connectivity is working as the touchpoint of the accessibility of online personal loans or salary loan through various websites or applications.

Both easy accessibility through any online loan app and the availability of loans beyond any extraordinary criteria make this personal loan facility lucrative to people. As the whole lending sector operates through online connectivity, there is no time boundary for applying for a loan. The whole system of online personal loans is present at the fingertips of the borrower.

Why are borrowers getting attracted to the online personal loan facility?

In India, obtaining formal credit was challenging due to the huge process. This whole process was quite time-consuming, too. Previously, the whole lending sector had drawbacks like collateral requirements, poor loan structure, and irregular credit problems. For this reason, previously preferred formal loans are losing borrowers’ interest. People are now quite interested in informal online loans from any instant loan app.

The digital lending situation has been reshaped with the inception of online platforms for quick loan facilities. The whole loan application and disbursal system becomes simple. No previous technical knowledge is required to apply for the loan. Another reason behind the demand for the online loan sector is digital solutions over in-person communication. In-person face-to-face communication needs physical visits to the bank or financial institutions. On the other hand, the digital solution is easy to obtain directly from home.

In the case of the digital personal loan facility, it is also advantageous for both lenders and borrowers to review and submit documents quickly. There is no need for extra hectic paperwork, too. The verification process by lenders is an instant process on digital platforms. The biometric verification of the borrowers can be done easily from the submitted data of consumers. Due to its fast verification process, instant cash loan disbursal can be done instantly within hours. The whole procedure is so fast that consumers can easily get the loan amount. They can satisfy their needs for emergency money at any time and from anywhere.

But these were all some basic changes in the digital loan sectors. Some other changes are truly revolutionary for the lending sector. For example, a customized loan solution is one of them. Usually, the lender reviews the credit score and creditworthiness of the borrowers. Based on that, a completely customized personal loan facility is provided to the borrower. Apart from this, an AI chatbot is another extra tool that helps borrowers find suitable lending options. The strongly secure interface also makes sure that no data is hacked or licked by any chance. So, the overall lending experience will be quite satisfying for borrowers.

Bottom line:

Day by day, the financial behavior of borrowers is changing based on their daily needs and emergency requirements. To fulfill those needs, online personal loans are providing the ultimate assistance. Without disturbing the financial stability, borrowers can easily repay the loan EMI within a flexible time frame.