Share market trading can seem like a wild ride. You’ve got to stay ahead of the pack, always knowing what’s happening. The secret to success, you ask? The article will tell you about candlestick patterns, and trend analysis might be the magic combo you need.

Understanding Candlestick Patterns

Candlestick patterns might sound fancy, but all they do is give us a picture of how prices are moving. For folks who are into the nitty-gritty of the stock market, learning how to read candlestick patterns is usually one of the first things they get good at. And trust me, it’s an art all of its own.

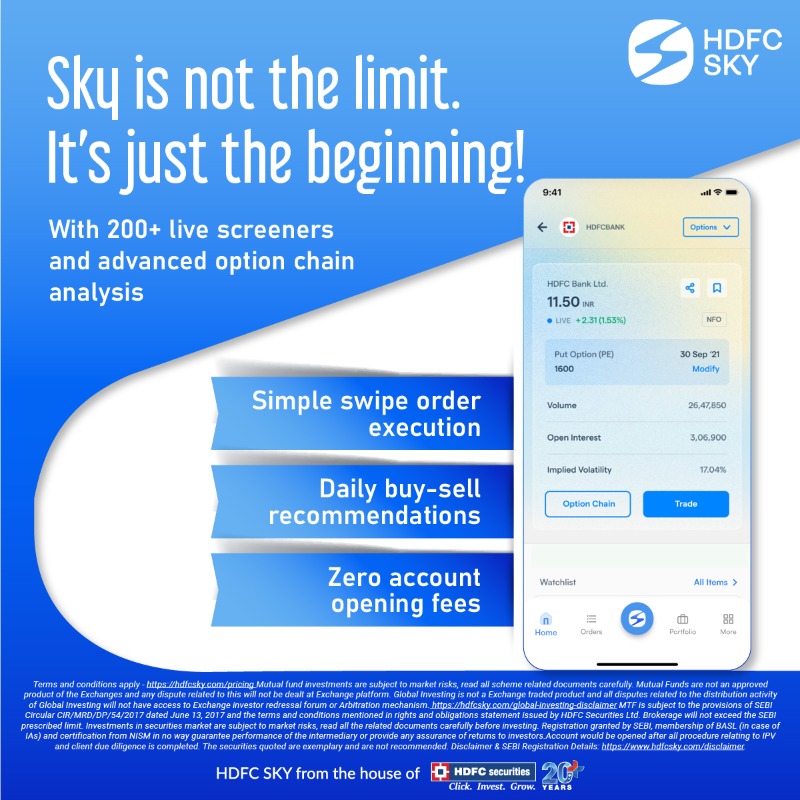

One of the fundamental aspects of candlestick patterns is their ability to signal potential trend reversals or continuations. For instance, a bullish engulfing pattern may suggest a significant shift from a bearish trend to a bullish trend. Recognizing these patterns in real time can be a great tool for traders seeking to make the right and informed decisions in the fast-paced environment of the stock market app ecosystem.

The Power of Trend Analysis

Alright, let’s dive into trend analysis and how it fits into the whole IPO app trading. You see, the world of trading isn’t just about second-by-second candlestick patterns. It’s more like a marathon than a sprint. Imagine trend analysis as your trusty compass. It guides you in the right direction by pinpointing where the market is headed in the long term.

Whether that’s over weeks, months, or even years, many traders lean on technical indicators like moving averages and trendlines to get a feel for the current marketplace. But add candlestick patterns to the mix, and you’ve got yourself one savvy trading strategy. You can think of trading major indices, like Bank Nifty and BSE Sensex, as yet another level of the game. To thrive here, understanding long-term trends isn’t just a bonus – it’s a must. And that’s where your trusty trend analysis comes into play once again.

Integrating Candlestick Patterns and Trend Analysis

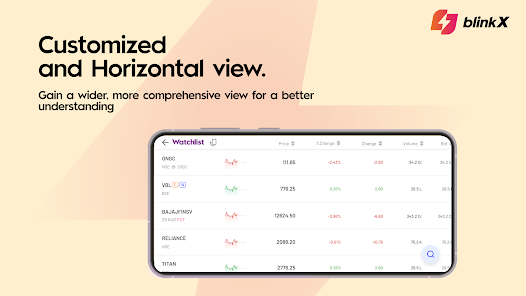

Say you’re eagle-eyed on a bullish (upward) market trend—as traders would term it—and you want to maximize your gains by hopping in at just the right spots. This is where your best buddy, candlestick patterns, comes in. It’s like a treasure map pointing to the golden opportunities to dive in with long positions.

On the other hand, let’s picture a bearish (downward) market trend. Now, you need to play it smart and know when to pull the plug. That’s where candlestick patterns again strut their stuff by flashing signs of potential trend reversals. This could help you exit gracefully by pouncing on short trades at the right moment.

Especially if you’re into intraday trading—that’s buying and selling stocks through a stock trading app within a single day—you know you can’t afford to miss a beat.

Conclusion:

Using candlestick patterns along with trend analysis can be a big help for traders. It’s like having a double-edged sword to navigate through the tricky world of the stock market. This is even more important when dealing with big leagues like Bank Nifty and BSE Sensex. Once you’ve created a Demat account, understanding the little details of candlestick patterns helps us understand the bigger picture of long-term trends. Then, we can make better decisions, whether we’re taking action right away in short-term day trades or strategizing for bigger movements in the market.