The share market plays a central role in the modern financial system by connecting companies that need capital with individuals seeking growth opportunities. For many participants, understanding how the share market is structured is the first step toward making informed financial decisions. With easier access through tools like an Online Share Market App and an Indian Stock Trading App, participation has expanded beyond professionals to everyday investors. However, wealth creation in the share market depends not only on access but also on knowledge of how the system operates.

This explains the structure of the share market, its key components, and how each part contributes to steady wealth creation over time.

Understanding the Share Market Structure

The share market is not a single place but a well-organized system that allows buying and selling of shares in a regulated manner. Its structure ensures transparency, price discovery, and fair participation for all market participants.

At a broad level, the share market is divided into different segments, each serving a specific function. These segments work together to create a stable environment where investments can grow when approached with discipline and planning.

Primary Market: The Entry Point for New Shares

What Is the Primary Market?

The primary market is where shares are issued for the first time. Companies enter this market to raise funds directly from investors by offering ownership stakes. This process helps businesses expand operations, reduce debt, or invest in new projects.

Role in Wealth Creation

For investors, the primary market offers early participation in a company’s growth journey. While not all offerings deliver returns, carefully evaluating financial statements and business objectives can help investors identify opportunities aligned with long-term wealth goals.

Secondary Market: Where Trading Happens Daily

Meaning of the Secondary Market

The secondary market is where existing shares are bought and sold among investors. Prices fluctuate based on demand, supply, and available information. This market provides liquidity, allowing investors to enter or exit positions as needed.

Importance for Investors

The secondary market enables price discovery and reflects market sentiment. Regular participation through an Indian Stock Trading App allows investors to monitor holdings, track price movements, and make timely decisions without physical paperwork.

Market Participants and Their Roles

Retail Investors

Retail investors form a significant portion of the share market. They typically invest for long-term goals such as education funding or retirement planning. Access through an Online Share Market App has simplified participation and portfolio monitoring.

Institutional Participants

Institutional participants manage large pools of funds and influence market trends through volume-based activity. Their involvement adds depth and stability to the market structure.

Market Intermediaries

Intermediaries facilitate transactions, ensure settlement, and maintain compliance with regulations. Their role supports smooth functioning and protects investor interests.

Regulatory Framework and Market Stability

A strong regulatory framework is essential for maintaining trust in the share market. Regulations ensure fair practices, prevent misuse of information, and safeguard investor funds.

By enforcing disclosure requirements and trading norms, the regulatory system reduces uncertainty. This stability supports long-term investing, which is a key factor in wealth creation.

Market Segments Based on Investment Style

Equity Segment

The equity segment involves ownership-based investments. Over time, equities have shown the potential to outperform other asset classes when held with patience and regular review.

Derivative Segment

This segment allows participants to manage risk or speculate on price movements. While it offers flexibility, it requires advanced understanding and careful use.

Debt-Related Instruments

Debt-based instruments provide predictable returns with lower risk compared to equities. Including them helps balance a portfolio and manage volatility.

Technology and Access to the Share Market

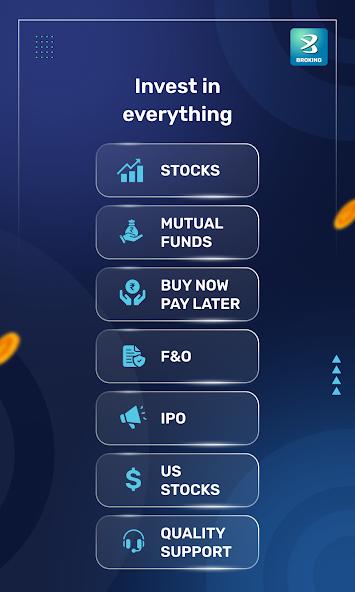

Digital platforms have transformed how individuals participate in the share market. Features such as real-time data, account management, and transaction history are now available through an Online Share Market App.

An Indian Stock Trading App enables investors to research, execute, and track investments efficiently. This accessibility encourages disciplined investing, which is essential for long-term wealth accumulation.

Risk and Return Relationship in Market Structure

Every segment of the share market carries a different level of risk. Understanding this relationship helps investors align choices with financial goals.

Diversification across sectors and market segments reduces exposure to sudden fluctuations. The structured nature of the share market supports diversification by offering multiple investment options within a regulated environment.

Long-Term Wealth Creation Through the Share Market

Wealth creation in the share market is not driven by short-term price movements but by consistent participation and informed decision-making. The structured system allows investors to:

- Invest systematically over time

- Reinvest earnings for compounding growth

- Adjust portfolios based on life stages

By focusing on fundamentals rather than frequent trading, investors can benefit from economic growth reflected in corporate performance.

Common Misunderstandings About Market Structure

Many new participants assume the share market is unpredictable. In reality, its structure is designed to manage risk through transparency and regulation.

Another misconception is that frequent activity leads to higher returns. The market structure supports long-term holding strategies more effectively than constant buying and selling.

Conclusion

The share market structure provides a clear framework that supports disciplined investing and long-term financial growth. From the primary market to daily trading in the secondary market, each component contributes to stability and opportunity.

With the availability of tools like an Online Share Market App and an Indian Stock Trading App, investors can participate more efficiently while staying informed. Understanding how the share market functions allows individuals to make thoughtful decisions, manage risk, and steadily build wealth over time.

When approached with patience and clarity, the structured share market becomes not just a place for transactions, but a reliable path toward sustainable wealth creation.