In this world of financial uncertainty, having a strong and better credit score is not just a number; it’s a financial lifeline. It determines the interest rate you pay, the loans you qualify for, and even your employability. What if we told you that instant cash loans can be your secret weapon for boosting your credit score? Let’s delve deep into instant personal loans to know how they can be used to boost your credit score.

What is a Credit Score?

Let’s first look at what a credit score is. A credit score is a number representing a person’s creditworthiness issued by credit institutions like CIBIL and Experia. Credit score denotes the estimate of how likely the borrower is to repay the borrowed amount. Credit scores range from 300 to 900.

Usually, online lenders or even banks prefer a credit score above 700. It is called a good credit score, which means the borrower has the capability of repaying the loan amount on time. A poor credit score can limit your options, whether you’re applying for a car loan, a home loan, or even a business loan online.

Instant Personal Loan Apps: A Misunderstood Tool

Instant personal loan apps are relatively new to the financial market. Due to this, many people associate personal loans with bad debt, overlooking their potential as a tool for financial empowerment.

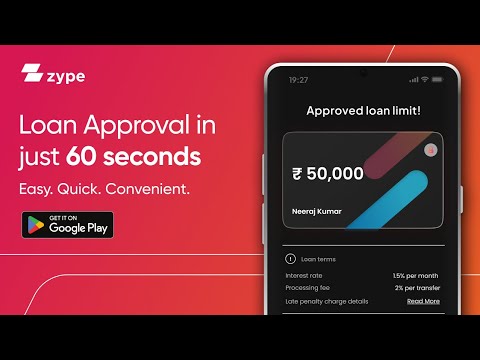

Quick personal loans are easy to apply and quick to approve, making them a feasible option for quick cash needs. As with a quick loan app, you can get loan instantly. But it can also be used to improve your credit score.

How does Credit Score Work?

Credit scores are calculated using numerous factors that include credit utilization, payment history, and the diversity and life of credit accounts. Instant personal loan apps can affect these factors positively and help you improve your credit score.

- Credit Utilization: Instant personal loans can help you consolidate your debts, reducing your credit utilization ratio, which positively impacts your credit score.

- Payment History: Regular and on-time payments toward your loans and credit card bills can significantly enhance your chances of having a good credit score.

- Credit Mix: Having different forms of credit, such as revolving and installment loans, can contribute to a better credit score.

Strategic Use of Instant Personal Loan

Despite all the myths surrounding a fast loan, they can be used to boost your credit score. Here’s how you can utilize instant personal loan apps to boost your credit score:

- Debt Consolidation: You can use the instant personal loan amount to pay off high-interest credit card balances. This moves your debt to a single, manageable account with lower interest rates.

- Payment Discipline: It is easier to create a repayment plan and stick to it rather than a pile of credit bills. Also, consistent payments show credit rating agencies that you’re trustworthy.

- Short-Term Financing: For quick and urgent financial needs, an instant personal loan is a better option than maxing out your credit cards, which can negatively impact your credit score.

Instant personal loans or a Flexi loan can be a double-edged sword; they can either boost your credit score or cause it to plummet, depending on how responsibly you use them. In the landscape of financial instruments, instant personal loans are emerging as not just a quick fix but a valuable asset for credit score management.