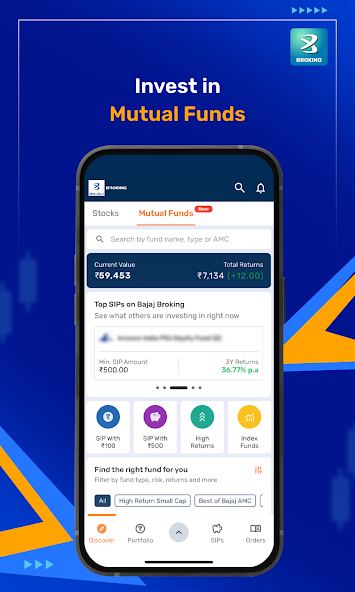

Saving regularly requires a clear plan and consistent action. Online Mutual Funds Investment has become a practical way for individuals to build savings through structured contributions. With digital access and simplified processes, investors can begin small and maintain steady participation in the market. Many individuals exploring the Share Market now prefer systematic investing methods that allow gradual wealth building without relying on large one-time investments.

A disciplined approach supported by a sip app india helps investors automate contributions and monitor progress over time. Instead of timing the market, individuals can invest at regular intervals and stay focused on long-term goals. Online Mutual Funds Investment provides flexibility, transparency, and convenience, making it easier for people to build savings through structured financial planning.

Understanding Online Mutual Funds Investment

What It Means

Online Mutual Funds Investment refers to investing in funds through digital platforms that allow users to select schemes, contribute regularly, and track performance. This method simplifies the process of entering the Share Market by allowing investors to begin with manageable amounts. Over time, regular contributions can accumulate and grow, depending on market performance and investment duration.

Why It Is Relevant Today

Digital access has made it easier to manage investments from anywhere. Investors can review portfolios, adjust contributions, and monitor returns without complex procedures. Using a sip app india allows individuals to maintain consistency and stay committed to long-term goals without manual tracking.

Benefits of Investing Online

Convenience and Accessibility

Online investing removes the need for physical paperwork and in-person visits. Investors can start, pause, or adjust contributions through a digital interface. This convenience encourages regular participation and helps maintain discipline.

Transparency in Tracking

Online platforms provide clear updates on contributions, returns, and portfolio value. This transparency helps investors understand how their savings are growing and allows them to make informed decisions.

Flexible Contribution Options

Online Mutual Funds Investment allows individuals to choose contribution amounts that suit their budget. Investors can start with small amounts and increase them gradually as income grows.

Planning Savings Through Systematic Contributions

Setting Clear Goals

Every investment plan should begin with a defined objective. Goals may include long-term savings, education planning, or financial stability. Once the target amount and timeline are clear, investors can estimate how much to contribute regularly.

Choosing a Contribution Method

Many investors prefer systematic contributions because they allow gradual entry into the Share Market. This approach reduces the pressure of investing large sums at once and helps maintain consistency. A sip app india can automate contributions and reduce the risk of missing payments.

Reviewing Progress

Regular reviews help ensure that contributions remain aligned with financial goals. Investors should check their progress periodically and adjust contributions if necessary.

Role of Discipline in Building Savings

Importance of Consistency

Consistency is one of the most important factors in long-term investing. Even small contributions made regularly can accumulate over time. Missing contributions may slow progress toward financial goals.

Managing Expectations

Market performance can vary over time. Investors should focus on long-term growth rather than short-term fluctuations. Staying consistent with Online Mutual Funds Investment helps maintain stability despite market changes.

Avoiding Emotional Decisions

Investors often react to short-term market movements. A structured investment plan helps reduce emotional decisions and encourages a disciplined approach.

Strategies for Effective Online Mutual Funds Investment

Start Early

Beginning early allows more time for contributions to grow. Even modest monthly investments can accumulate significantly over long periods.

Increase Contributions Gradually

As income increases, investors can raise their contribution amounts. This helps accelerate progress toward financial goals without causing financial strain.

Diversify Investments

Diversification helps balance risk. Investors can spread contributions across different funds to reduce exposure to any single market segment.

Use Digital Tools

A sip app india provides reminders, tracking tools, and automated contributions. These features help investors maintain discipline and stay focused on long-term plans.

Monitoring and Adjusting Investments

Annual Reviews

Financial situations change over time. Investors should review their plans annually and adjust contributions if necessary. This ensures that the investment plan remains aligned with current goals.

Adjusting for Life Changes

Major life events such as career changes or new financial responsibilities may require adjustments. Online platforms make it easier to update contribution amounts or investment choices.

Staying Informed

Understanding market trends and economic changes helps investors make better decisions. While long-term investing reduces the need for constant monitoring, staying informed provides valuable context.

Avoiding Common Mistakes

Delaying Investments

Waiting for the right time to invest may lead to missed opportunities. Starting early with manageable contributions helps build momentum.

Inconsistent Contributions

Irregular contributions may affect long-term results. Automated investments through a sip app india can help maintain consistency.

Ignoring Long-Term Goals

Short-term market movements should not distract from long-term objectives. Staying focused on goals helps maintain discipline and avoid unnecessary changes.

Conclusion

Online Mutual Funds Investment offers a structured way to build savings through regular contributions and disciplined planning. By using digital tools and systematic investing methods, individuals can participate in the Share Market without relying on large one-time investments. A sip app India supports consistency by automating contributions and providing clear tracking features.

Over time, regular investments and careful planning can support steady financial growth. Online Mutual Funds Investment allows individuals to set goals, monitor progress, and adjust strategies as needed. By maintaining discipline and reviewing plans periodically, investors can strengthen their approach and work toward long-term financial stability through structured Mutual Funds Investment.