The digital asset market has opened new opportunities for individuals looking to participate in modern financial systems. Crypto trading has become a widely discussed topic as more investors explore digital assets through structured platforms. With easy access through a cryptocurrency app, trading digital currencies is now possible for both beginners and experienced participants.

However, successful crypto trading requires more than just placing trades. It involves understanding market behavior, using tools wisely, and managing risks carefully. A reliable cryptocurrency app plays a vital role by offering access, tracking, and control in one place. This guide explains how crypto trading works, how to use a cryptocurrency app effectively, and how smart investors can approach trading responsibly.

What Is Crypto Trading?

Crypto trading refers to the process of buying and selling digital assets with the goal of managing value changes over time. Unlike traditional markets, crypto trading operates continuously, allowing transactions at any time.

A cryptocurrency app enables users to access markets, view prices, and place trades securely. For smart investors, understanding how crypto trading functions is essential before entering the market.

Why Investors Are Choosing Crypto Trading

Many investors are drawn to crypto trading due to accessibility and digital ownership. A cryptocurrency app allows users to monitor assets in real time and manage trades without complex processes.

Crypto trading also offers flexibility in trade size and timing. With proper planning and discipline, investors can use a cryptocurrency app to explore trading while maintaining control over their financial decisions.

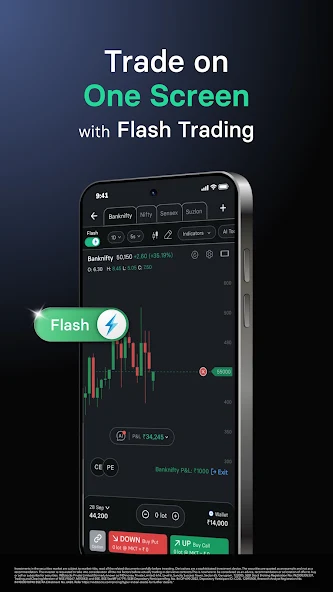

Understanding the Role of a Cryptocurrency App

A cryptocurrency app is a digital platform that allows users to participate in crypto trading from a mobile device or computer. It provides features such as price tracking, order placement, account management, and transaction records.

For smart investors, a cryptocurrency app simplifies crypto trading by presenting essential information clearly. It acts as the main interface between the user and the digital asset market.

How Crypto Trading Works Step by Step

Account Setup

To begin crypto trading, users must create and verify an account within a cryptocurrency app. Verification helps protect accounts and ensures secure access.

Funding the Account

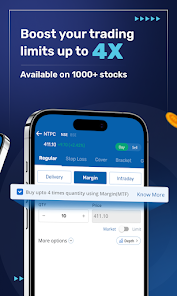

After setup, users add funds using supported payment methods. Funding the account allows participation in crypto trading activities.

Selecting Trading Pairs

Crypto trading involves choosing digital assets to buy or sell. A cryptocurrency app displays available trading options and current prices.

Placing a Trade

Users enter trade details and confirm the order. The cryptocurrency app processes the transaction and updates the account balance accordingly.

Types of Crypto Trading

Short Term Trading

Short term crypto trading focuses on smaller price movements over limited timeframes. It requires close monitoring and quick decision-making through a cryptocurrency app.

Long Term Trading

Long term crypto trading involves holding digital assets for extended periods. Investors using this approach rely on market research and long-term planning rather than frequent trades.

Both approaches depend on using a cryptocurrency app that provides accurate data and secure access.

Importance of Security in Crypto Trading

Security is a critical factor in crypto trading. A reliable cryptocurrency app uses encryption, secure login systems, and activity monitoring to protect user accounts.

Smart investors also follow personal security practices such as strong passwords and regular account checks. Combining platform security with user awareness reduces risks in crypto trading.

Managing Risk in Crypto Trading

Crypto trading involves market fluctuations that can impact asset values. Smart investors manage risk by setting limits, avoiding overexposure, and maintaining realistic expectations.

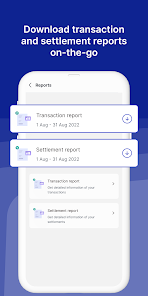

A cryptocurrency app often includes tools that help users track performance and review transaction history. These features support informed decisions and better risk control.

Common Mistakes to Avoid in Crypto Trading

Many new participants rush into crypto trading without sufficient understanding. Common mistakes include overtrading, ignoring fees, and reacting emotionally to price changes.

Using a cryptocurrency app responsibly involves planning trades, reviewing data, and staying disciplined. Learning from experience helps investors refine their crypto trading approach over time.

Legal and Regulatory Awareness

Before engaging in crypto trading, investors should understand applicable regulations in their region. Compliance requirements help ensure transparency and protect users.

A cryptocurrency app that follows regulatory guidelines provides an added layer of confidence for investors participating in crypto trading.

Tips for Smart Crypto Traders

Start Gradually

Smart investors often begin crypto trading with smaller amounts. This approach allows learning without unnecessary pressure.

Track Market Information

Regularly reviewing price trends and transaction data within a cryptocurrency app supports informed decisions.

Focus on Strategy

Successful crypto trading depends on planning rather than impulse. A clear strategy helps investors stay consistent and avoid unnecessary risks.

How Crypto Trading Fits Into Financial Planning

For many investors, crypto trading is part of a broader financial plan. Digital assets can complement traditional approaches when managed responsibly.

A cryptocurrency app allows investors to track holdings, review performance, and adjust strategies as needed. This structured access supports long-term planning.

The Future of Crypto Trading

Crypto trading continues to evolve with improvements in technology and regulatory clarity. Cryptocurrency app platforms are becoming more structured, supporting safer and more organized trading experiences.

As awareness grows, crypto trading is expected to attract more informed participants who prioritize security, education, and responsible decision-making.

Conclusion

Crypto trading offers opportunities for investors who approach it with knowledge and discipline. Using a reliable cryptocurrency app helps simplify access, improve tracking, and support secure participation. For smart investors, understanding how crypto trading works and managing risks responsibly are essential steps toward long-term engagement.

By learning gradually, using a cryptocurrency app effectively, and maintaining a clear strategy, investors can participate in crypto trading with confidence. As digital assets continue to develop, informed crypto trading remains a practical option for those seeking structured involvement in the digital asset market.